Toyota Tundra Depreciation

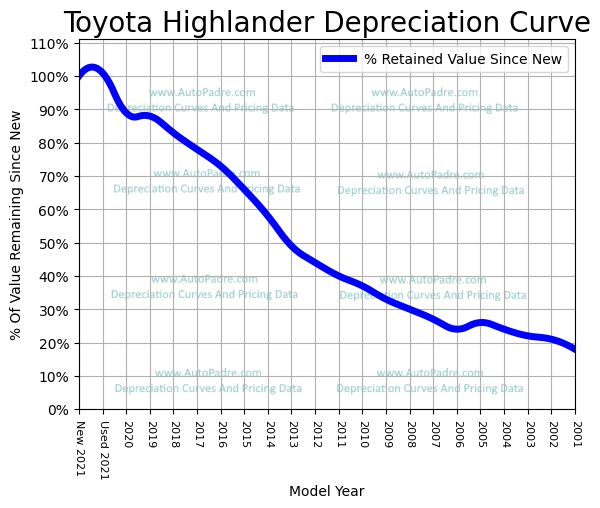

Toyota does so impressively with three models 4Runner Tacoma and Highlander ranking in the Top 10 after 5 years.

Toyota tundra depreciation. 2012 Deduction Limit 139000. Toyota Corolla Depreciation Rate 5 Year Depreciation Rate A 2020 Toyota Corolla has a forecasted 5 year depreciation rate of 39. Business Use Tax Deduction on vehicles Section 179.

Its that value that keeps depreciation in check for a long list of. Some models it beat to the honor include the. Depreciation Depreciation is an estimate of the reduction in value incurred by owning and operating a vehicle over a period of time.

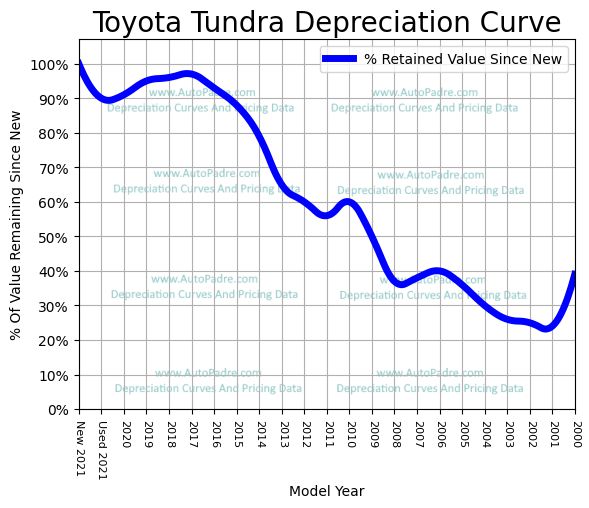

Ranked at 5 is Toyota Tundra at 327 average depreciation. Toyota is emulating the strategy it employs up and down its car and SUV lineup by offering a hybrid option that uses the twin-turbocharged 35-liter engine. 2012 Limit on Capital Purchases 560000.

Cost to own data is not currently available for the 2009 Toyota Tundra Double Cab-V8 Dbl 47L V8 5-Spd AT SR5. It loses just 359 percent of its value or about 12000 over the first five years of its life. If you want a vehicle line that will hold its value over the long run Toyota is and has been.

Toyota has earned a reputation for making trouble-free vehicles and that in turn is a big driver in high resale value. Its for all of these reasons that the Toyota Tundra is the Full-Size Truck Best Resale Value Award winner for 2021. Section 179 Deduction limit after adjustment for inflation has increased to 139000 maximum allowance would have been only 25000 prior to the new legislation.

Toyota Car Depreciation By Model Calculator. 2022 Tundra Hybrid Powertrain. According to iSeeCars the average five-year depreciation rate of the Toyota Tundra is 359 the lowest in its class.